FTXトークンは大手仮想通貨取引所「FTX」が発行する仮想通貨ユーティリティートークンです。所有することでFTXで取引がしやすくなるなどメリットは多数あります。

FTXは2022年11月に破産状態に陥ったために、FTTも大暴落しました。

初心者の方は特にですが、FTTを購入するのはハイリスクなので、避けた方が良いと思います。

今回は、FTXトークンの歴史や特徴、将来価格の予想について詳しく解説していきます。

FTXトークン(FTT)とは?

本日ご紹介するFTXトークン(FTT)は大手仮想通貨取引所「FTX」作られたオリジナルトークンです。「FTX」はバハマに本社を置く仮想通貨取引所です。

尚、FTX創設者のサム・バンクマン・フリード氏は弱冠29歳でありながら、個人資産265億ドルを超えると2021年のフォーブス誌で取り上げられました。才能溢れる若手の実業家であり、彼の才能に期待して将来価格が上がると考えて投資している人も多くいるでしょう。

| 仮想通貨(暗号資産)名称 | FTX Token |

|---|---|

| 単位(ティッカーシンボル) | FTT |

| 価格(2023年2月28日時点 以下項目も同じ) | 182.19円(1.496256ドル) |

| 時価総額 | 59,921,348,320円 |

| 時価総額占有率(仮想通貨の総時価総額に占めるFTTの割合) | 0.0% |

| 時価総額ランキング | 213位 |

| 市場流通量(循環している供給量) | 328,895,104FTT |

| FTTのHP | オフィシャルHP |

| FTTの公式Twitter |

なお、FTXトークン(FTX)はリキッドバイFTXで買うことができます。

仮想通貨取引所FTXの特徴

それでは、FTXトークンの説明をする前に、FTXの特徴について解説します。

豊富な金融取引が用意されている

日本の取引所においては仮想通貨の取扱商品は、現物取引またはレバレッジ取引のいずれかです。ところが、FTXでは金融デリバティブ取引の一つである先物取引の取扱いも存在しています。なお、先物取引とは、将来の売買について、現時点で価格や数量を予測して取引形態で、より多くの利益を狙う投資家が利用することが多い取引です。

また、株式トークンの取扱いもしています。「Fractional Stocks Offerings(FSO)」と呼ばれるもので、これは企業の株式をトークン化したもので、FTX独自の特徴ある商品です。このように、仮想通貨の取引所という枠に収まらず、ブロックチェーン技術をさらに波及させる先進的な取り組みを行っている取引所でもあるのです。

高いレバレッジをかけられる

国内取引所では、金融商品取引法の改正に基づき仮想通貨のレバレッジ倍率を2倍までに制限しているところがほとんどです。ところが、FTXでは現状、20倍のハイレバレッジを仮想通貨にかけることが可能です(レバレッジ取引はリスクも高まるので初心者の人はまずは現物取引がおすすめです)。ただし、FTXは日本居住者の利用を制限しているため、ここについてはFTXで直接の恩恵を受けることはできません。なお、2021年7月まではFTXの最大レバレッジは100倍でしたが、当局の要請に基づき20倍に引き下げられました。

FTXが2022年11月に破産状態になってしまった

上記のような特徴のある取引所ですが、2022年11月に、債務超過で破産状態にあることがわかりました。

そのため、取引所としては利用しにくい状態にあると言えますので、FTTトークンも今は購入しない方が安全でしょう。

FTXトークン(FTT)の歴史

FTTは2019年7月にFTXへ新規上場してます。2020年末までは、ほぼ値動きがありませんでした。

ところが、2021年に入り急騰し始めました。2021年1月始値が約5.7ドル、4月につけた最高値が約59.6ドルです。これは約4か月で10倍以上に高騰したことになり、驚異的な数字といえます。

それではこのような急騰の要因はどのようなものがあるのか、以下で説明していきます。

FTX独自のDEX上でエアドロップを実施

DEXとは、分散型取引所のことで、中央管理者不在の仮想通貨取引所を意味します。「エアドロップ」とは仮想通貨の無料配布キャンペーンのことです。FTXがソラナブロックチェーン上で運営している「Serum」という分散型取引所があります。そのSerumが2021年2月~3月にかけてソラナ財団と共同でイベントをおこない、参加者に対して、仮想通貨COPE2000枚を無料配布しました。この影響により、Serumが注目を集めて、運営元であるFTXにもプラスの影響があり、FTXトークンの価格にもポジティブな影響を及ぼしたと考えられます。

NBAチームのアリーナ命名権を獲得

2021年3月には、FTXがアメリカのプロバスケットボールリーグ「NBA」の「マイアミ・ヒート」の、ホームアリーナの命名権を獲得することに成功しました。前述のサム・バンクマンフリード氏は「今回の機会はアリーナに名前が付けられるというだけでなく、マイアミやその周辺都市で拡大しているコミュニティに新たな価値を提供できるチャンスだ」と述べ、FTX認知度拡大に大きい期待を示しています。

NFLのルーキー選手がFTX関連企業とスポンサー契約を締結

2021年4月、米国のフットボールリーグNFLの注目ルーキー選手であるトレバー・ローレンス氏が、FTXの関連企業「Blockfolio」とスポンサー契約を結びました。

この契約の特徴的な点は、ローレンス氏への報酬がすべて仮想通貨によって支払われる点です。

現状、仮想通貨は実用よりも投資対象としてみなされていますが、いずれは社会への実需に貢献することで、その価値を確たるものにすることを目指してます。これは決済手段としての確立し社会インフラ化を図るPR活動の一つです。

このようにFTXは取引所の事業をするにとどまらず、先進的な取組みを積極的におこなって、社会からの注目を集めています。

LegerX親会社を買収することを発表した

LegerXとは担保付現物決済のビットコインスワップやオプション取引など先進的な仮想通貨取引が行える取引所です。アメリカ商品先物取引委員会から承認を受けている信用度の高い取引所です。

2021年8月にFTXの関連企業である「FTX.US」が、仮想通貨のデリバティブ取引を提供しているLedgerXの親会社「Ledger Holdings Inc」を買収すること公表しました。

その公表の後、FTXトークンの価格は大幅に上昇し、約50ドルから80ドルに価格を上げました。

このように、FTXが会社を買収することによってもFTTトークンの価格に大きく影響を与えることがあるので、FTXの動向に注意することが非常に大切です。

大谷翔平選手がFTXとパートナーシップを結ぶ

FTXは、2021年11月に米国のプロ野球リーグMLBのロスアンゼル・スエンゼルスの大谷翔平選手とパートナーシップ契約を結びました。CEOのサム・バンクマン・フリード氏は、「翔平は野球界において、短い間に超越した存在となリ、パートナーシップを結ぶことになった。彼は野球以外でも、世界を良くしていくことに情熱を持っている。それは弊社とも通じることだ。翔平と様々な慈善活動で協力できることになったのを、うれしく思う」とコメントしている。

2022年11月の大暴落

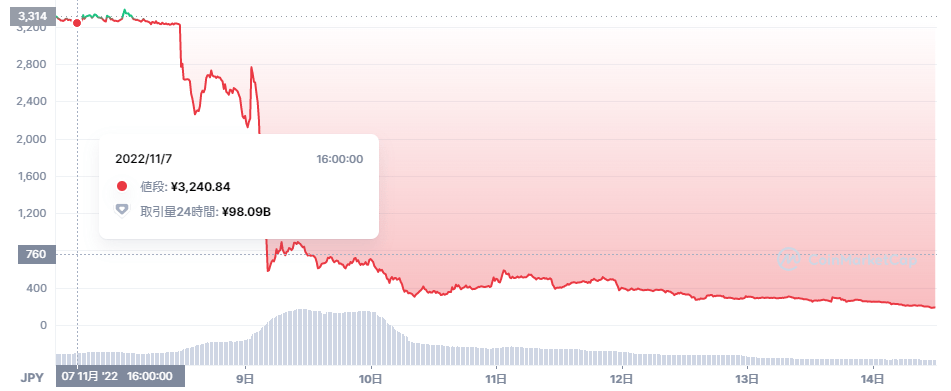

FTXが破産となったことで、FTTトークンは2022年11月に大暴落してしまいます。

母体となる取引所への信頼が失われたことで、FTTへの信頼も損なわれてしまったのです。

上記のチャートはその大暴落した時のものですが、3,000円以上の価値があったものが、短期間で400円を割り込んでいますので、大損してしまった投資家もいるのではないでしょうか。・

FTXトークン(FTT)の特徴は?詳しく解説

それでは、FTXトークンのトークンとしての特徴について解説します。

ステーキングすることが可能

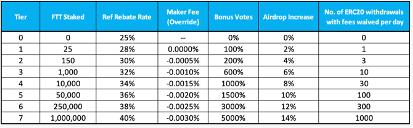

FTXトークンを長期保有することでステーキングが可能です。ステーキングとは、銀行にお金を預け入れて利息をもらうようなシステムで仮想通貨を保有するだけで、報酬を得られる仕組みです。FTXトークンは、取引所の「FTX」でステーキングが可能です。FTXトークンの保有量に応じて報酬や様々な特典を得られるため、値上がり益であるキャピタルゲインだけでなくインカムゲインや付随的なメリットを狙うことも可能となっています。

なお、「FTX.jp」によるとFTXトークンをステーキングすることで、以下のようなメリットが得られます。

紹介リベート率の増加

FTXトークンのステーキング量に応じて、知り合い等にFTXを紹介した場合の紹介料がより高い割合で支払われます。

メーカー料金(オーバーライド)

Stakersには、通常の料金スケジュールをオーバーライドする新しいメーカー料金スケジュールがあります(標準のFTT料金割引に加えて)。これらのリベートは、MMレベルベースのリベートとスタックします。

ボーナス投票

FTTを保有することでボーナス投票を獲得します(保持されているFTTと取引量に基づく標準の投票数に加えて)

エアドロップ報酬の増加

SRMエアドロップ(および場合によっては後で他のエアドロップと歩留まり)をもらうことができます。

送金手数料が無料になる

ERC20とETHの送金に伴う手数料が所定の回数分無料になります。

IEOチケット

FTXでIEOが行われるトークンの参加チケットをステーキング数量に応じて取得することができます。

バーンにより供給がタイトになる仕組み

仮想通貨のバーンとは発行しているトークンを消滅させることをいいます。市場から買い取ったり、運営元が保有している仮想通貨ごとに焼却する仕組みが一般的です。バーンが行われると供給量が減少するため、1トークンあたりの価値は上昇します。つまり、値上がり益を狙う投資家にとってはメリットがあると言えますね。

FTXは発生した取引手数料の3分の1分のFTXトークンをバーンすることで流通量を減らしています。つまり、取引をすればするほどFTXトークン保有者に還元されているということとなります。非常に上手な運営です。

Liquid by FTXにて国内初上場

2022年2月10日、FTXトークンがLiquid by FTXにおいて国内初上場を果たしました。ここでは、今回FTXトークンが上場された取引所であるLiquid by FTXについて解説します。

Liquid by FTXとは

「Liquid by FTX」はFTX株式会社が運営する日本における仮想通貨取引所です。全身となる運営会社は、2014年に設立された「Quoine」です。2017年に金融庁から暗号資産交換業の登録を受けました。また、2021年に第一種金融商品取引業として、金融庁の登録を受けたことで、現物取引・デリバティブ取引のプラットフォームの提供を開始しました。FTXと親和性が高いことから、2022年2月にFTXから買収提案があり、それを受けたことで「Liquid by FTX」が誕生しました。それと同時に国内で初めてソラナ(SOL)とFTXトークン(FTT)の取り扱いを開始しました。

取扱通貨

Liquid by FTXの大きな特徴として、通貨ペアが豊富であるという点があります。Liquid by FTXでは、円建て以外にも米ドル・ユーロ・シンガポールドル・香港ドル・豪ドルとさまざまな法定通貨での取引に対応しているほか、ビットコイン・イーサリアム・QASH(独自トークン)は、仮想通貨同士での取引も可能です。国内の取引所の中ではかなり先進的な取り組みを行っています。

また、現在取り扱いのある仮想通貨は下記の通りです。

※ただし、こちらの取引所では現物取引は行えないので注意が必要です。又、FTXの破産によって、今後の継続性に疑問があります。

FTXトークン(FTT)の将来の価格の予想

取引所のトークンは、価格が順調に上がることも多いため、それだけでも将来価格がかなり高くなると予想する声もありましたが、FTXの経営破綻によって、ちょっと厳しい将来が予想されます。

もちろん、FTX社の経営再建がなされた場合にはトークン(FTT)の今後の価格は上がるでしょうけれど、リスクの高い投資だと思います。

FTXは世界的に人気とはなったのですが、過去最大の規模の取引所の破産という結果を招いてしまったので、他の仮想通貨の価格にも悪影響を及ぼしてしまいました。今後に100ドルという目標は達成されると予想もありましたが、ちょっと難しいのではないかと思います。

将来の価格予想としては厳しめなので、初心者の投資家は、他のコインに投資した方が良いかなと思います。

FTXトークンのまとめ

2021年度最も上昇したソラナ(SOL)を大々的に成功させたのも「FTX」のマーケティングに追うところが大きいといわれています。創業者のサム・バンクマン・フリード氏は非常に才能ある若手実業家であるため、今後もその動向に注目が集まっています。

ただし、経営的に破産した取引所のコインに手を出すよりは、安全性の高いコインを購入して、手堅く利益を獲得していった方が良いでしょう。

なお、多くの銘柄の仮想通貨を手数料無料で売買したい場合には、国内取引所ではコインチェックがおすすめです。マネックスグループが運営しているため、経営破綻のリスクも小さいでしょう。

| 取引所名 | コインチェック | DMMビットコイン | ビットバンク | BIT Point(ビットポイント) | Huobi Japan | bitFlyer(ビットフライヤー) |

|---|---|---|---|---|---|---|

| 取引所画像 |

|

|

|

|

|

|

| 銘柄取扱数 | 18銘柄 | 20銘柄 | 21銘柄 | 14銘柄 | 26銘柄 | 17銘柄 |

| 販売所取引手数料 | 無料 | 無料 | 無料 | 無料 | 無料 | 無料 |

| 取引所取引手数料 | 無料 | ー | Maker -0.02% Taker 0.12% (一部銘柄を除く) |

無料 | Maker 0.012~0.150% Taker 0.036~0.150% | 0.01~0.15% |

| レバレッジ取引の有無 | ー | 2倍 | ー | 2倍 | 2倍 | 2倍 |

| 最低取引単位 | 500円相当額 | 販売所:0.0001 BTC 取引所:- |

取引所:- 販売所:0.00000001 BTC |

販売所:0.001 BTC 取引所:- |

販売所:0.001 BTC 取引所:0.0001 BTC |

販売所:0.00000001 BTC 取引所:0.001 BTC |

| 運営開始日(日本国内) | 2014年8月 | 2018年1月11日 | 2014年5月7日 | 2016年3月 | 2016年9月 | 2014年1月 |

| 公式サイト | コインチェック 公式サイト |

DMMビットコイン 公式サイト |

ビットバンク 公式サイト |

BIT Point(ビットポイント) 公式サイト |

Huobi Japan 公式サイト |

bitFlyer(ビットフライヤー) 公式サイト |